Reveal

Potential

Reach the heights of trading with us! We offer a wide range of trading accounts suitable for traders of all levels.

Get Started

First steps

How to Start Earning

1step

Think

Consider several ways to earn money on the exchange. Assess their advantages and disadvantages. Choose among them the most suitable for you.

2step

Choose

Find several tools on our platform for investing and choose among them the most suitable one. Register and open a minimum deposit.

3step

Earn and Learn

Try different approaches, learn from your actions, gain experience. Analyze your steps, work on your mistakes, improve your skills and strategies.

Features

Open a World of New Financial Opportunities

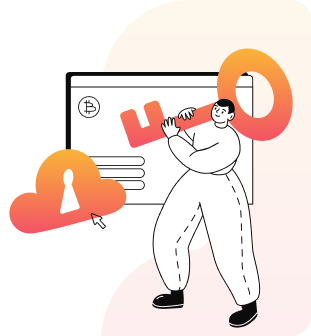

Investments

Explore a wide range of trading instruments, carefully selected for their high liquidity, allowing you to make optimal investment decisions.

Analytics

Gain access to exclusive market research empowering you to learn how to predict chart movements alongside our team of traders.

VIP Club

Join an international community of traders and unlock privileges that are typically unavailable to the majority of market participants.

Safety

The real-time margin calculation system reflects the market revaluation of all client positions, ensuring an accurate risk.

Explore a variety of options and trade with confidence, taking advantage of global market trends and making informed investment decisions.

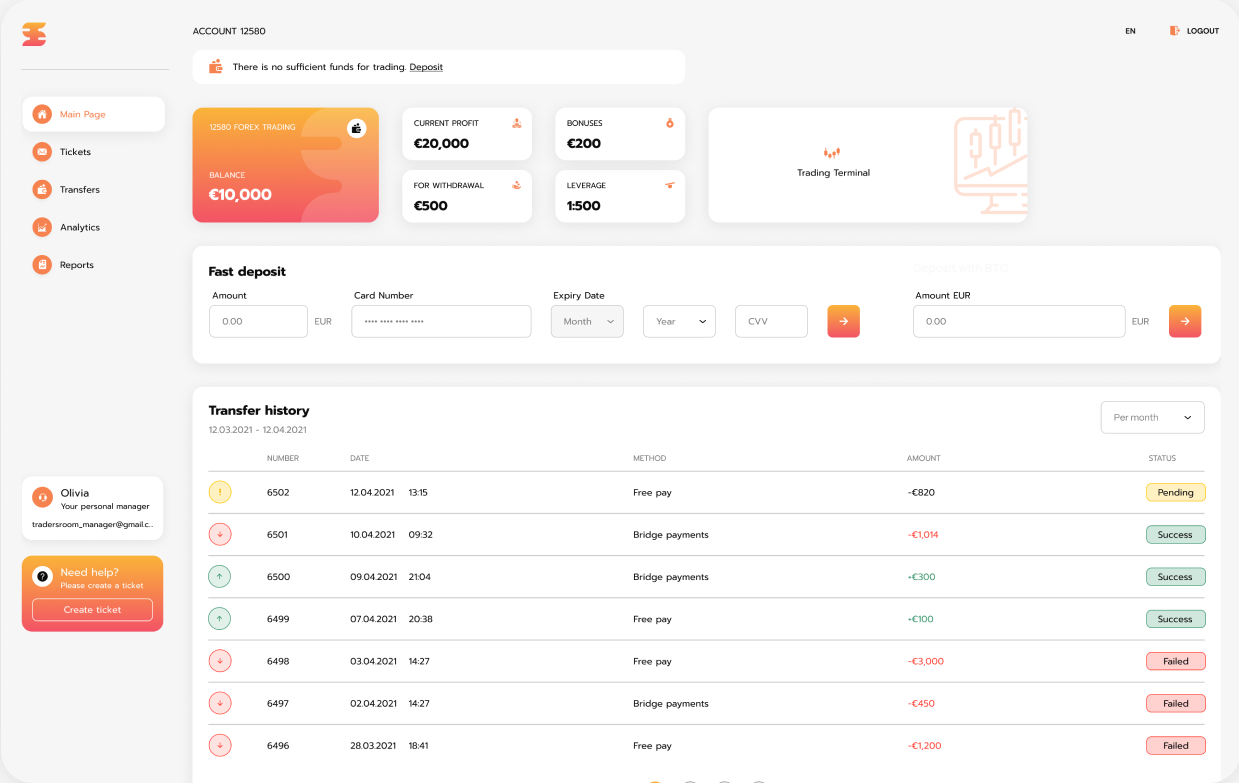

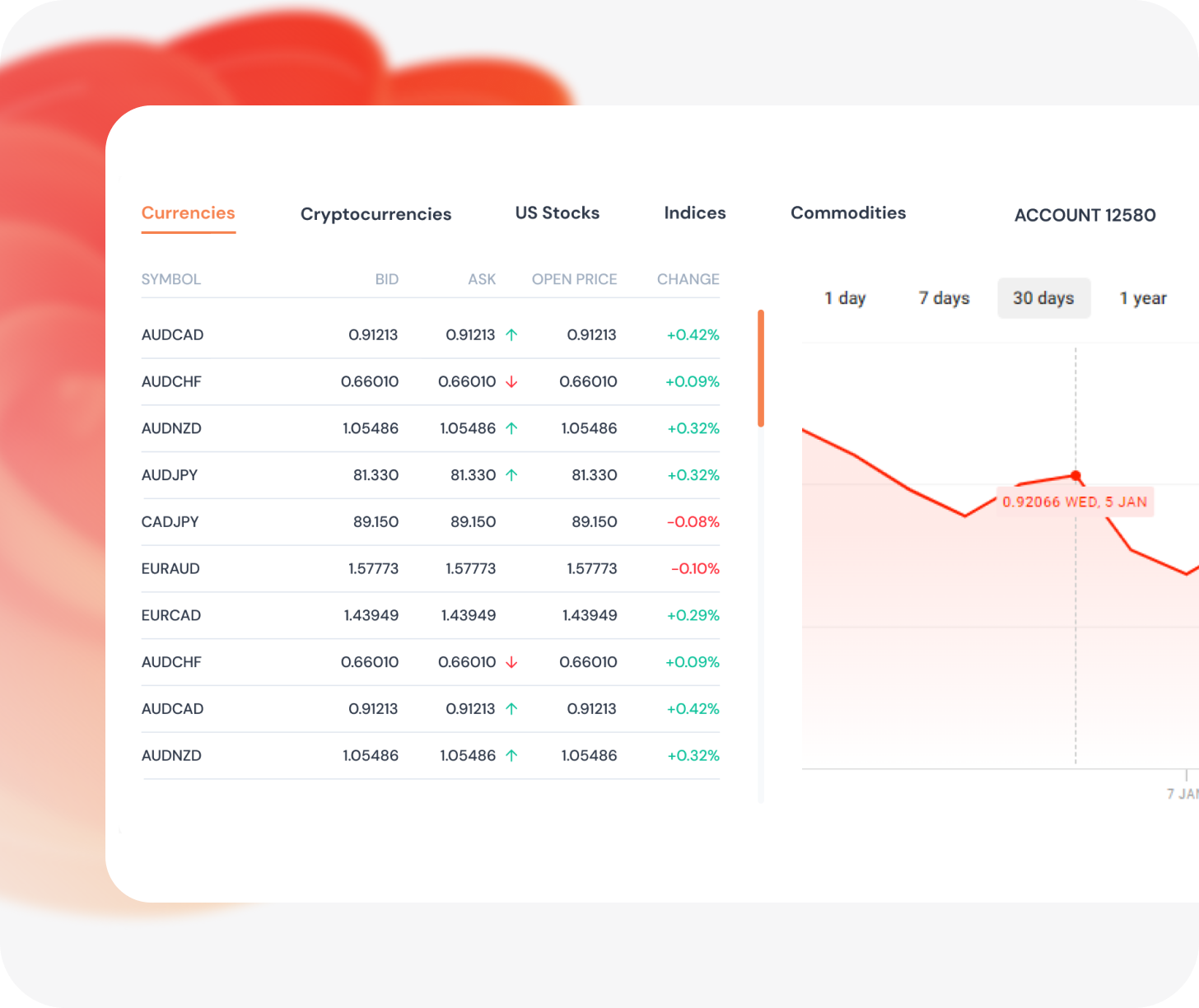

Custom reports

Personalized Reports Customized for Your Needs

Every trader has unique requirements for analyzing and monitoring their trading activity. That's why our company provides customized reports specifically tailored to each client's needs. Our team of professionals works closely with traders to create personalized reports that highlight performance metrics, market analysis or visualization of specific data.

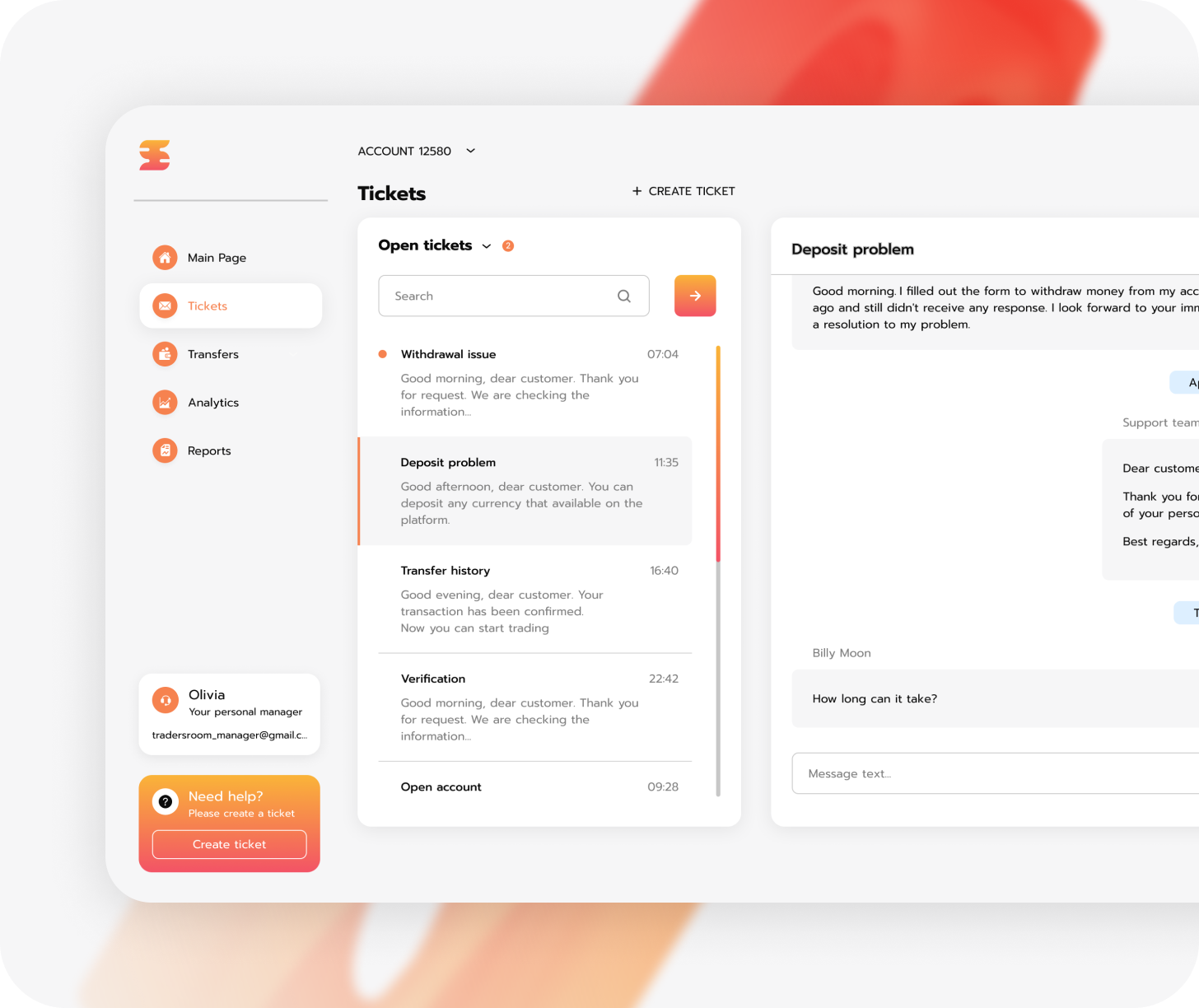

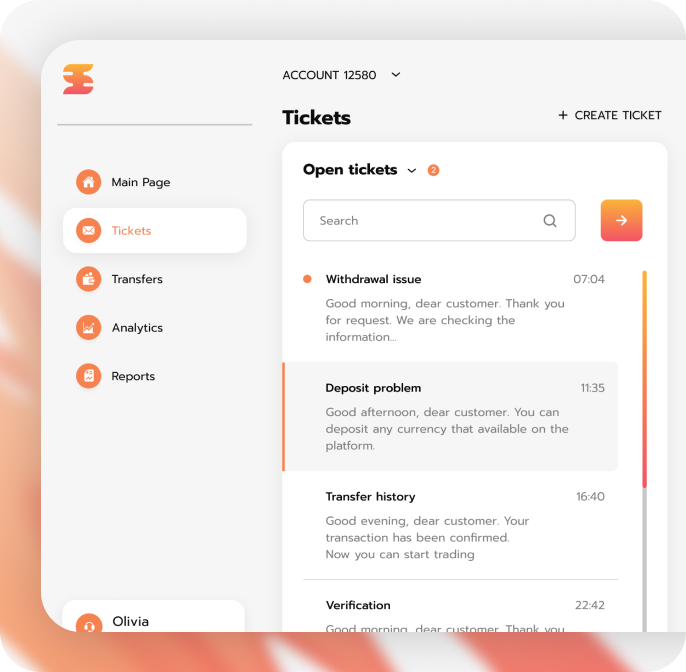

Personalized support

Comprehensive Support Service for Every Trader

Our company prioritizes effective communication with clients, providing a professional support service to address all financial inquiries related to trading. Our team of experts is always available to assist with any questions and ensure seamless trading experiences.

News

Stay Up to Date With the Trends and Happenings

26.01.2026

UK inflation rises to 3.4% in December, led by tobacco and travel costs

UK inflation rose to 3.4% in December, ending a five-month period of decline and coming in slightly higher than economists had expected. The increase highlights the uneven progress in bringing price pressures back under control, even as some costs continue to ease.

The main drivers behind the rise were higher tobacco prices and increased airfares. A rise in tobacco duties pushed up cigarette prices, while airline ticket costs jumped during the busy holiday travel period. Together, these factors made a noticeable contribution to the overall inflation rate.

Food prices also added to inflationary pressure. While the pace of food price growth has slowed compared with previous years, costs for everyday items such as bread, cereals and vegetables continued to rise, putting additional strain on household budgets. Some categories, including certain goods and services, saw more stable or falling prices, which helped prevent a sharper increase in inflation.

Compared with several other major European economies, the UK’s inflation rate remains relatively high, underlining the challenges facing policymakers. The Bank of England, which had already begun to ease interest rates toward the end of last year, is now under pressure to carefully balance the need to support economic growth while ensuring inflation does not become entrenched.

Looking ahead, economists expect inflation to gradually fall again over the coming months, but warn that progress may be uneven. Global energy prices, tax changes and seasonal factors could all continue to influence short-term movements. The government has reiterated that reducing the cost of living remains a key priority, while critics argue that households are still feeling the effects of prolonged price pressures.

21.01.2026

Audi F1 team sign new sponsorship deal with Gillette and Nexo

The Audi Formula One Team Expands its Sponsorship Portfolio

The Audi Formula One team has recently secured new sponsorship agreements with two major players: shaving brand Gillette and digital assets platform Nexo. These additions signal Audi's strategic approach to enhancing its presence and influence on a global scale.

Gillette's Return to Formula One

Procter & Gamble (P&G), the parent company of Gillette, makes a notable return to Formula One. Previously, P&G was associated with the Benetton team in the 1990s. Gillette's involvement with Audi marks a significant comeback, aligning with its tradition of forming powerful bonds with sports fans worldwide. The brand's association with Braun and Venus further complements Audi's robust portfolio of global partners. Gillette's emphasis on engineering excellence and design aligns seamlessly with Audi's credo, promising to uplift fan experiences and showcasing their commitment to inspire confidence and emotion through their products.

Nexo's Partnership: Embracing the Crypto Revolution

Nexo's partnership with Audi marks yet another step in integrating cryptocurrency into mainstream sports. As part of Audi's strategy, Nexo joins Revolut, an existing title partner that offers cryptocurrency trading among its services. The collaboration emphasizes both organizations' focus on disciplined growth and innovation. Nexo's involvement will provide Audi's fans and Nexo's clients with exclusive experiences and novel ways to engage - a move that underscores the increasing intersection of digital finance and sports marketing.

Additional Strategic Partnerships

Beyond these high-profile deals, Audi has been on a roll with establishing strategic partnerships. The team also welcomed software firm NinjaOne and hospitality company Hyatt. These collaborations serve to reinforce its brand appeal and operational efficiency, effectively broadening its sponsorship portfolio to an impressive nine brands.

A Statement from Audi's Chief Commercial Officer

Stefano Battiston, Audi’s Chief Commercial Officer, elaborated on the significance of these partnerships. He emphasized the importance of a global stage for the Audi Revolut F1 Team, highlighting that the collaboration with experts like Gillette leverages their vast consumer engagement expertise. These partnerships are instrumental not just in building the Audi brand but also in creating meaningful and enriched experiences for fans. Regarding Nexo, Battiston pointed out the partnership's role in their shared ambition to scale and innovate, thereby creating tangible value and enhancing fan engagement in a rapidly evolving digital world.

Bridging Technology, Sports, and Lifestyle

Audi's recent sponsorship ventures underline a strategic vision that bridges the worlds of technology, sports, and lifestyle. By partnering with renowned brands and innovators in digital assets, Audi aims to reinforce its brand identity while pushing the boundaries of traditional sports marketing. This multifaceted strategy not only augments Audi's reach into global markets but also marks a progressive step in Formula One's adaptation to modern financial landscapes.

Conclusion

In conclusion, Audi's latest sponsorship deals with Gillette and Nexo represent their continuous evolution and strategic alliances in the fiercely competitive world of Formula One. These partnerships are more than mere financial associations; they are a testament to Audi's commitment to engineering excellence, consumer engagement, and innovation. As Audi continues to build its brand around these core values, the future looks promising for the Audi Formula One team.

19.01.2026

What Is a Broker - A Beginner's Guide

Understanding the Role of Brokers in Financial Markets

A broker is a pivotal figure or entity in the trading and investing landscape, serving as the bridge that connects individual traders and larger financial markets. They facilitate transactions such as buying and selling shares, currencies, commodities, and various financial products. Essentially, brokers act as intermediaries, allowing individuals to access markets and liquidity providers that would otherwise be out of reach.

Services Offered by Brokers

In today's digital age, most brokers offer comprehensive platforms that encompass a wide range of financial instruments and tools. They provide market access, trading platforms, and often allow traders to use leverage, thereby enabling control of larger trade volumes with a relatively smaller capital commitment. However, it's crucial to understand that leverage magnifies both potential profits and risks, necessitating careful consideration before utilization.

Market Access Example

Consider a situation where you wish to trade the EUR/USD currency pair. Direct access to the interbank market is not feasible for retail traders; instead, your broker manages the trade on your behalf. Depending on the broker type, they might match your order internally (market maker) or route it to external liquidity providers (ECN/STP model).

The Importance of Choosing a Regulated Broker

While brokers are invaluable to individual investors by providing market access, selecting an unregulated broker can pose significant risks. Unregulated brokers may engage in dubious practices that can jeopardize your investment. Therefore, the regulatory status of a broker is a critical factor to evaluate to ensure the security and fairness of your trading experience.

Types of Brokers and Their Operations

Brokers can be categorized based on their operation styles and service models. The main types include market makers, ECN brokers, STP brokers, discount brokers, and full-service brokers. For instance, market maker brokers can cater better to beginners, offering straightforward platforms, while ECN brokers are favored by seasoned traders for direct market access and competitive pricing.

Cost Structure: Understanding Spreads and Commissions

Different brokers employ varied pricing models, typically involving spreads (the price difference between buying and selling) and commissions (fees per trade). For example, executing a trade in EUR/USD on a standard account might incur a spread cost, whereas an ECN account might have a smaller spread paired with a commission fee per side.

Comparative Tip for Selecting a Broker

For beginner traders, evaluating all associated costs, including spreads, commissions, and hidden fees, is imperative when choosing a broker. This thorough approach ensures a clear understanding of the overall trading cost structure, ultimately influencing your net profitability.

Evaluating Broker Reliability and Safety

Trustworthy brokers are distinguished by features such as regulatory compliance, transparent pricing, reliable trading platforms, and robust customer support. A regulated broker ensures that your trading activities are protected under specific legal frameworks, minimizing the risk of malpractice.

Testing Broker Offerings Safely

Many credible brokers allow prospective clients to open demo accounts. These accounts provide a risk-free environment to evaluate trading platforms and conditions, enabling you to familiarize yourself with the system before committing real capital. Starting with a small deposit is also a prudent strategy to test the broker's transaction execution and withdrawal processes.

Conclusion: The Critical Role of Brokers

Brokers are indispensable for accessing global financial markets, providing the necessary tools, leverage, and liquidity. However, the choice of a broker holds significant influence over your trading success and security. Ensuring that your chosen broker is regulated and trustworthy is a cardinal step in your trading journey. Remember, well-informed decisions backed by comprehensive research protect your investments and enhance your trading experience.

This content serves educational purposes and does not constitute financial advice. Always assess regulatory licenses before selecting a broker.

Further Learning and Resources

To deepen your understanding, explore additional guides like "What Is Crypto Trading - A Beginner's Guide," which covers the fundamentals, risks, and strategies for cryptocurrency trading. For an extensive comparison of brokers, visit the "Best Online Brokers of 2025" page, featuring a detailed analysis of reliable and regulated options in the market.

14.01.2026

World Liberty Financial Price Prediction 2026-2030: WLFI Token Analysis and Forecast

Market Background and Role of World Liberty Financial

World Liberty Financial (WLFI) emerges at an intriguing intersection of decentralized finance (DeFi) and traditional financial systems. With a robust backing by noted political figures, the project ambitiously seeks to synthesize the nuanced field of cryptocurrency with some of the systemic rigor of traditional banking. By operating efficiently on both the Ethereum blockchain and the Aave protocol infrastructure, WLFI distinguishes itself not merely as another DeFi player but as a potential vanguard for innovations in lending, borrowing, and crypto transactions. The underlying governance token, WLFI, offers token holders significant stakes in governance and revenue distribution, which could, in theory, transform both the project and investor returns significantly.

Tokenomics and Distribution Analysis

The foundation of any solid price prediction stems from understanding its tokenomics. With a total supply of 100 billion, WLFI's distribution is heavily weighted towards insiders, with 63% held internally and only 20% available through public sale. This setup presents both risks and rewards: a largely centralized model could ensure stability due to lower available supply; however, it may also deter investors cautious of centralization risk. While the initial token price pegged at $0.015 may seem conservative, the subsequent phases of distribution and locking periods will fundamentally influence WLFI’s market performance over the next few years.

Key Features and Competitive Position

WLFI’s distinguishing features include political backing, user-centric design, and integrated financial services, setting it apart from the crowded DeFi landscape. However, it faces formidable opponents in established players such as Aave, Compound, and MakerDAO. A unique political angle might offer regulatory leverage but could also attract scrutiny. The competition revolves around gaining substantial Total Value Locked (TVL) and user base, which are crucial for the platform's long-term viability.

WLFI Price Prediction 2026: Near-Term Market Dynamics

The year 2026 marks a pivotal entry point for WLFI into broader financial markets. Early volatility is anticipated following its public sale, with a confluence of scenarios defining its immediate price trajectory. Conservative estimates suggest a range from $0.012 to $0.025, factoring in potential regulatory hurdles and early investor sell-offs. Conversely, a bullish outlook projects prices between $0.045 and $0.075, hinging on successful adoption and regulatory progress. Key 2026 catalysts such as exchange listings and political endorsements will play significant roles in shaping early WLFI pricing actions.

WLFI Price Prediction 2027: Growth and Market Positioning

By 2027, WLFI's strength will lie in its maturation trajectory as it aims to transition from a politically motivated token to a substantial player in DeFi. The price prediction spans conservatively from $0.020 to $0.040, reflecting possible stagnation. Conversely, a bullish capture of market share could elevate WLFI pricing to between $0.100 and $0.175. Success hinges on differentiation—whether through competitive niches or broader market acceptance. Adoption metrics such as TVL, user base growth, and strategic partnerships will be critical indicators of WLFI's trajectory.

WLFI Price Prediction 2028: Expansion or Consolidation

With an eye on 2028, WLFI stands at a crossroads between expansion or acceptance as a mid-cap player. Prices may range conservatively between $0.030 and $0.065 if faced with aging protocol challenges. Yet, achieving a stable tier-2 positioning could see higher valuations, ranging up to $0.300 in bullish scenarios. Critical influences include evolving regulatory environments across the U.S., Europe, and Asia-Pacific, which could pivot WLFI towards favorable adoption should compliances align.

WLFI Price Prediction 2029: Performance and Market Cycles

As WLFI approaches 2029, its market performance will find itself at the mercy of broader cryptocurrency cycles. A conservative trajectory would see prices advancing to $0.080, whereas a bullish scenario could escalate it to $0.450, contingent upon external macroeconomic trends such as Bitcoin halving cycles and institutional adoption. Of importance is WLFI’s ability to ride market cycles strategically, whether in bull or bear markets, by anchoring on a compelling value proposition.

WLFI Price Prediction 2030: Long-Term Vision and Technological Shifts

The price predictions for 2030 encapsulate a framework of expectations from $0.050 to as high as $1.50 on the optimistic scale. Substantiating these valuations will require WLFI not only to harness technological evolutions such as quantum computing and CBDC integration but equally to exhibit operational excellence in servicing millions globally. Attaining valuations alongside DeFi greats like Uniswap and Aave will necessitate deft strategic moves and scalability solutions that can handle exponential user growth.

Risks and Uncertainties

Major risks looming over WLFI include regulatory challenges, particularly pertaining to its potential security classification that could restrict trading. Technical vulnerabilities like smart contract bugs also pose existential threats. Market dynamics bring forth competitive risks from both established players and innovative disruptors. Lastly, WLFI's unique political associations might expose it to reputational risks inherently absent in more neutral projects.

Investment Considerations: Strategies and Positioning

Investment strategies should reflect WLFI’s speculative nature. Risk-adjusted position sizing could range from conservative allocations of 0.5-1% for cautious investors, to higher stakes for those wagering on its political leverage. Approaching WLFI with diversification safeguards and milestone-based entry strategies enables disciplined trading. Continuous market monitoring and outcome assessments will ultimately justify low or high capital commitments.

Conclusion: The Road Ahead for World Liberty Financial

World Liberty Financial stands at a juncture where immense potential intersects with substantial uncertainty. While the rewards for successful execution are high, so too are the risks of navigating its complex path. Investors must take a balanced approach, considering both the political advantages and inherent vulnerabilities of the project. As the DeFi space rapidly evolves, WLFI's position within it—and its ultimate price trajectory—will depend on measured execution, adaptability, and the ability to maximize its unique opportunities while managing accompanying liabilities.